2020 Presidential Elections Analysis

Carine Hajjar

Air Wars: Presidential Campaign Ads

Every presidential election, millions of dollars are spent on campaign ads, whether that be on TV, the radio, social media, or elsewhere. Campaigns use all of these forms of media to meet voters where they’re at and persuade them from the comfort of their own homes or on their own social media feeds to 1) vote and 2) vote for their candidate.

Today I’ll be taking a general look at the use of ads over different elections, their purpose, their location, and the money spent on them. I ask the following questions:

- How much do elections spend on ads?

- Where do ads go?

- What do ads do?

- How does incumbency impact the “Air War”?

- What’s the latest with 2020?

- What does this all mean? Does it matter?

It’s important to note that data on the current ad spending is limited so I’ll be using restrospective analysis to look at the general properties of the Air War.

Big Spenders

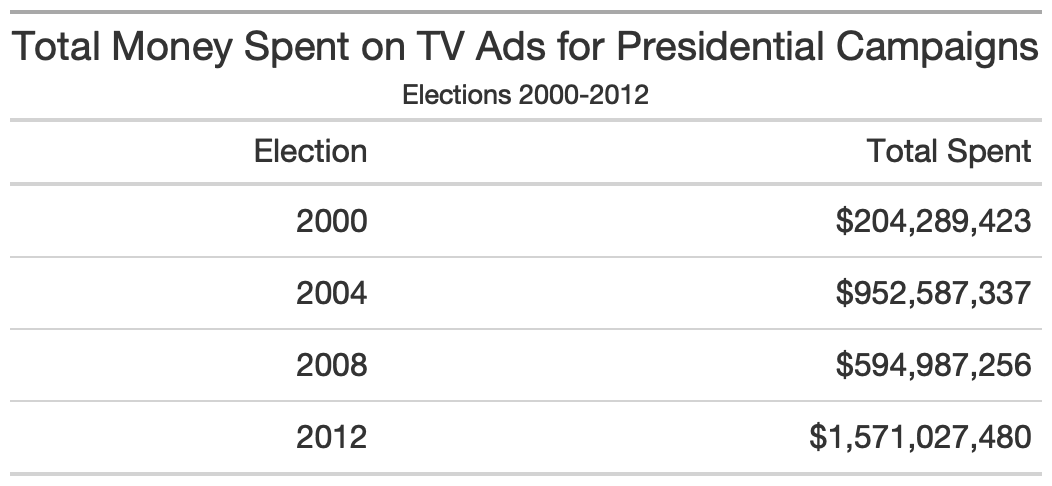

In the 2012 election, over 1 billion dollars was spent on TV ads.

- As an interesting side note, there is a pattern emerging with incumbency: years with incumbents running for reelection (2004 and 2012) have relatively higher spending than years when two new candidates are running (2000 and 2008). This could be explained by the well-known phenomena of incumbent advantage. Incumbency, afterall, is one of the strongest predictors of popular vote.

Media campaigning, as we can see, takes a bulk of a campaign’s monetary resources. Given this major expense, campaigns are as strategic as possible with their placement of TV ads.

Where’s the Money Going?

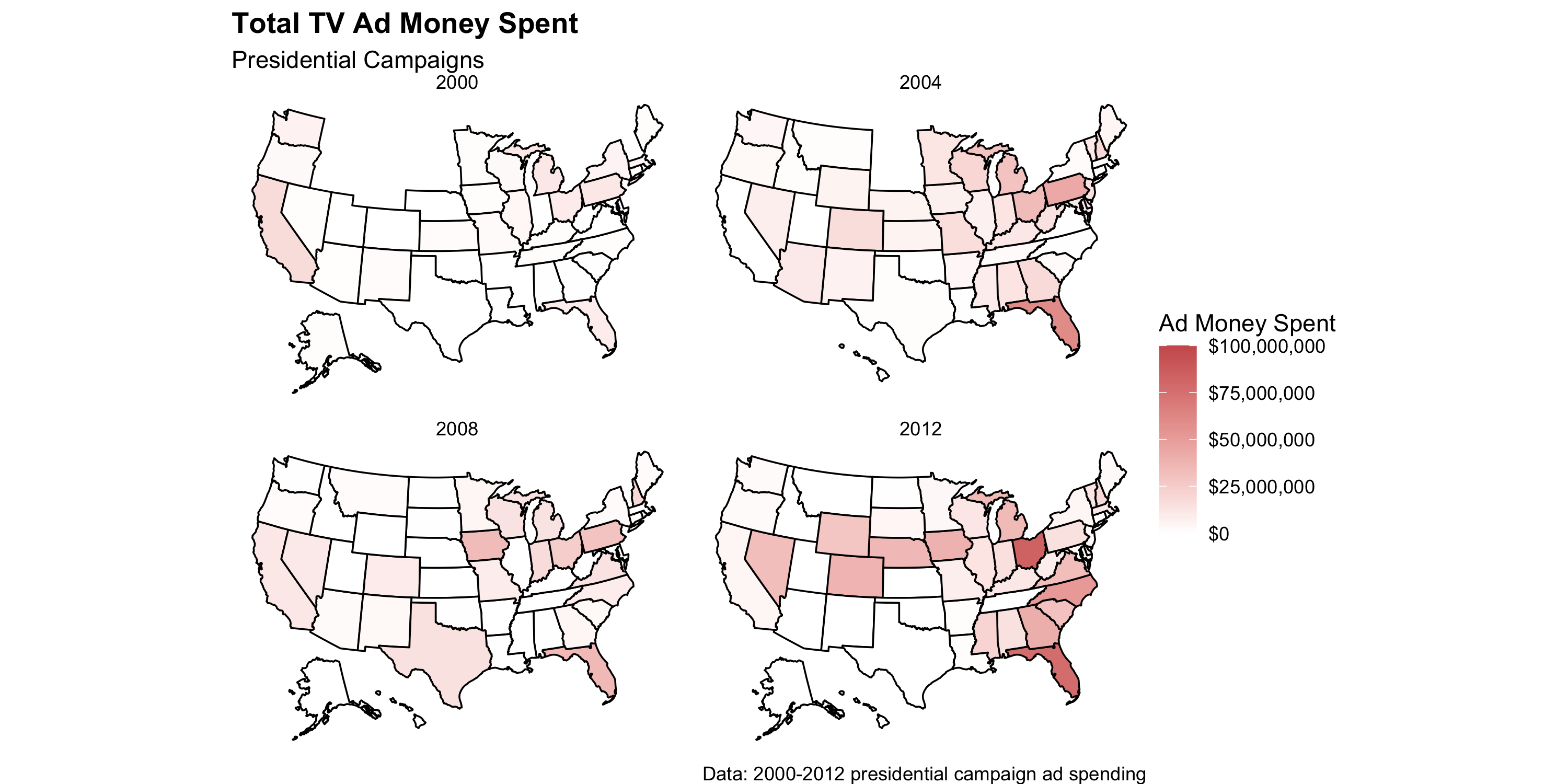

Looking at state-by-state spending gives us a better idea of how campaigns strategically employ their resources in the form of ads.

The first thing to notice is that TV ad spending has increased over time. 2012 is far “darker” than 2000. This could indicate tighter races, more TV use, or a shift in campaigning towards more media-centric persuasion. My instinct tells me that since 2000, since campaigns have become tighter and more divisive in a more polarized environment, campaigns are just generally more active and receiving more funding.

What we also see here is that major battleground states — most notably, Florida — receive the bulk of campaign ad spending. This intuitively makes sense: why would either the GOP or Democratic Party spend millions on Massachusetts ads if MA has gone blue in the presidential election since 1988 and surely will remain blue? Campaigns strategically allocate their ad spending to states where the vote share margin is expected to be the smallest. Take a look at 2012: Ohio, Florida, Iowa, Nebraska, and other Politico-designated swing states received large sums of campaign ad money. Meanwhile, Massachusetts, which was firmly expected to vote for Obama, got little to no ad money.

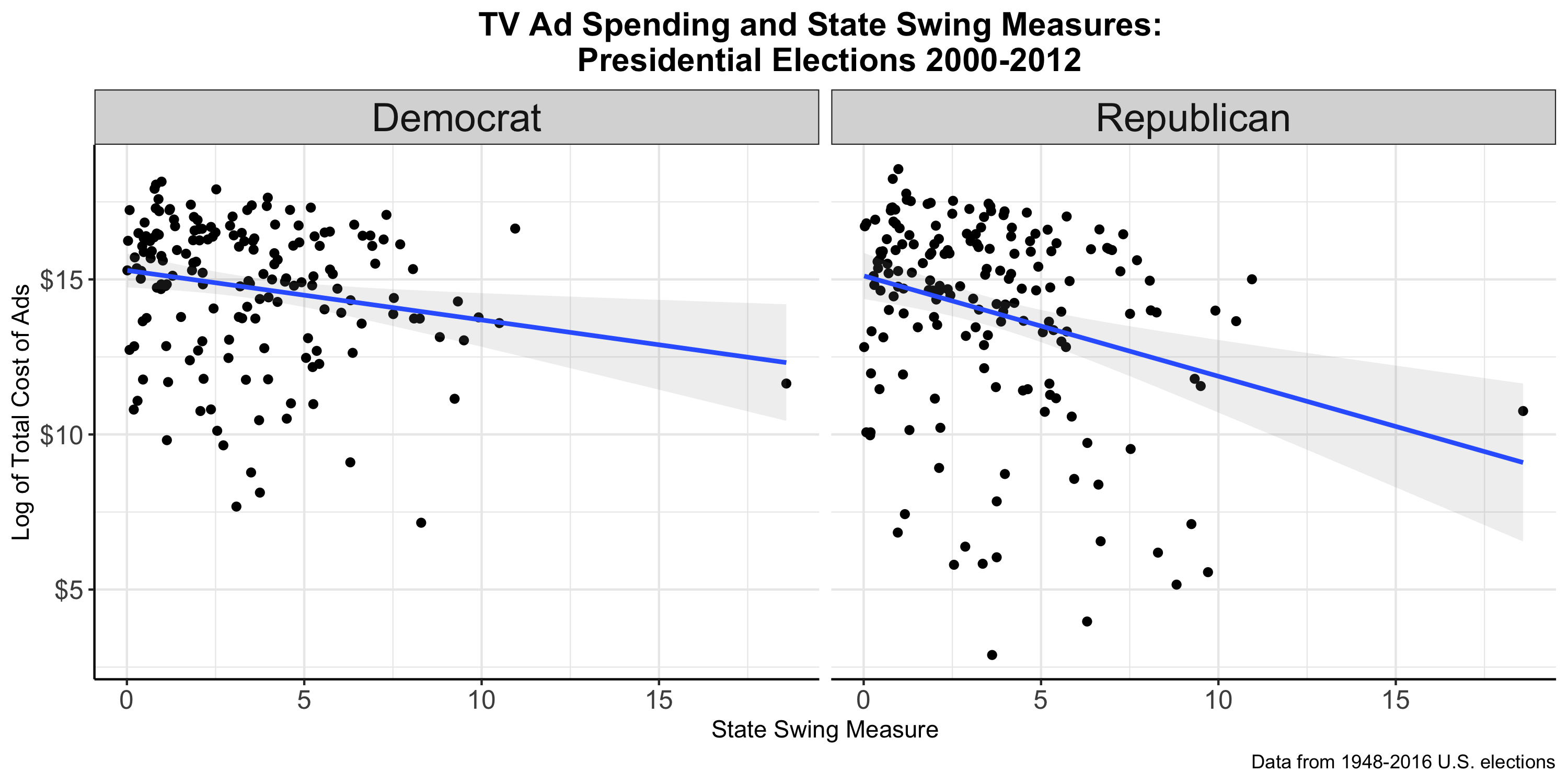

Seeing that battleground states receive the biggest spending, I wanted to check if there was any correlation with swing states using the measure I computed in blog 1. What I found is that there is a slight negative correlation between a state’s “swinginess” and its level of campaign ad spending. I found this odd - shouldn’t swing states, like battleground states, be the target of major campaigning? Are swing and battleground synonymous? It turns out that campaigns are spending the bulk of their TV budget on lesser-swing states. This could mean a couple things. Given the fact that swing is calculated retrospectively, perhaps campaigns are just choosing the wrong states as battelground targets. Another possibility could be that campaigns are unsure about what states will swing and by how much, so they stay safe and place their bets with less volatile states.

Main Points

- TV ad spending has gone up dramatically over time

- Races without an presidential incumbent see relatively more spending

- This could be due to the fact that both campaigns are fighting for votes without the incumbent advantage in the way

- Ad spending is concentrated in projected battleground states

- Looking restrospectively at swing states, there is a negative correlation between ad spending and the magnitude of swing

- This could either be due to campaigns playing it safe or incorrectly projecting battleground states

Incumbency and Ads

Last week I spent some time talking about incumbency and its impact on electoral outcomes. Incumbency is seen as a major advantage in elections and is a successful predictor of popular vote outcomes. Given these realities, I wondered if incumbency (specifically party incumbency) would impact ad spending and ad content.

Spending

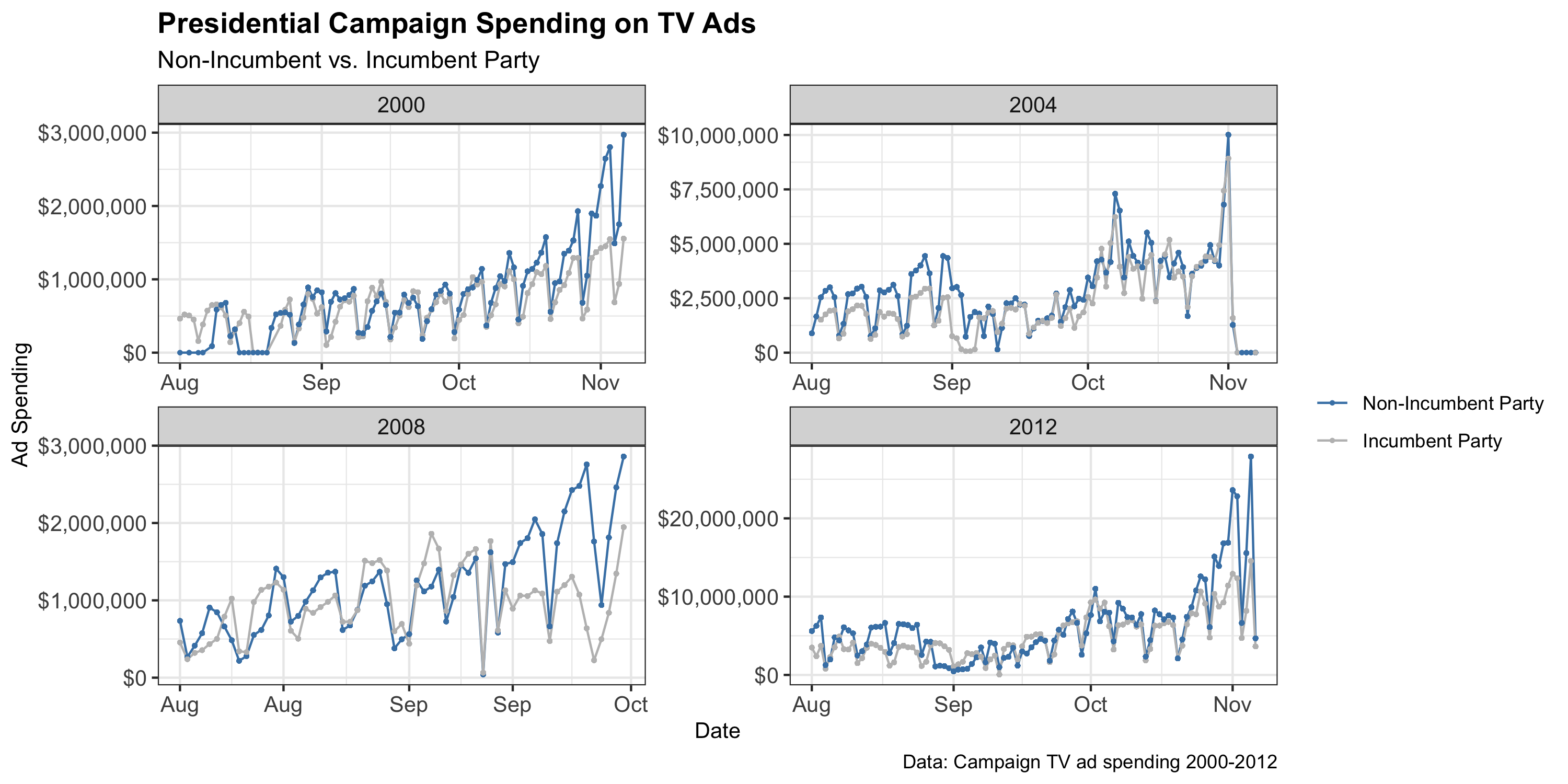

What we see is that challenger parties consistently outspend incumbent parties both over multiple elections and over the course of the election. I suspect that this is because challenger campaigns know they are facing the well-established incumbency advantage and have to fight an uphill battle.

Does Ad Spending Even Matter?

Another important feature of the graph above: both incumbents and non-incumbents spend more and more as they near election day. This is consistent with Gerber et al’s observation that ads are persuasive, but their impact decays almost immediately. Therefore, as Gerber et al note, campaigns with frequent, sustained ads will be able to maintain their persuasion of voters and hopefully turn out more support on election day. By buying more ads closer to election day, campaigns are maintaining their persuasiveness more productively and in a more cost-effective manner.

Ad Composition

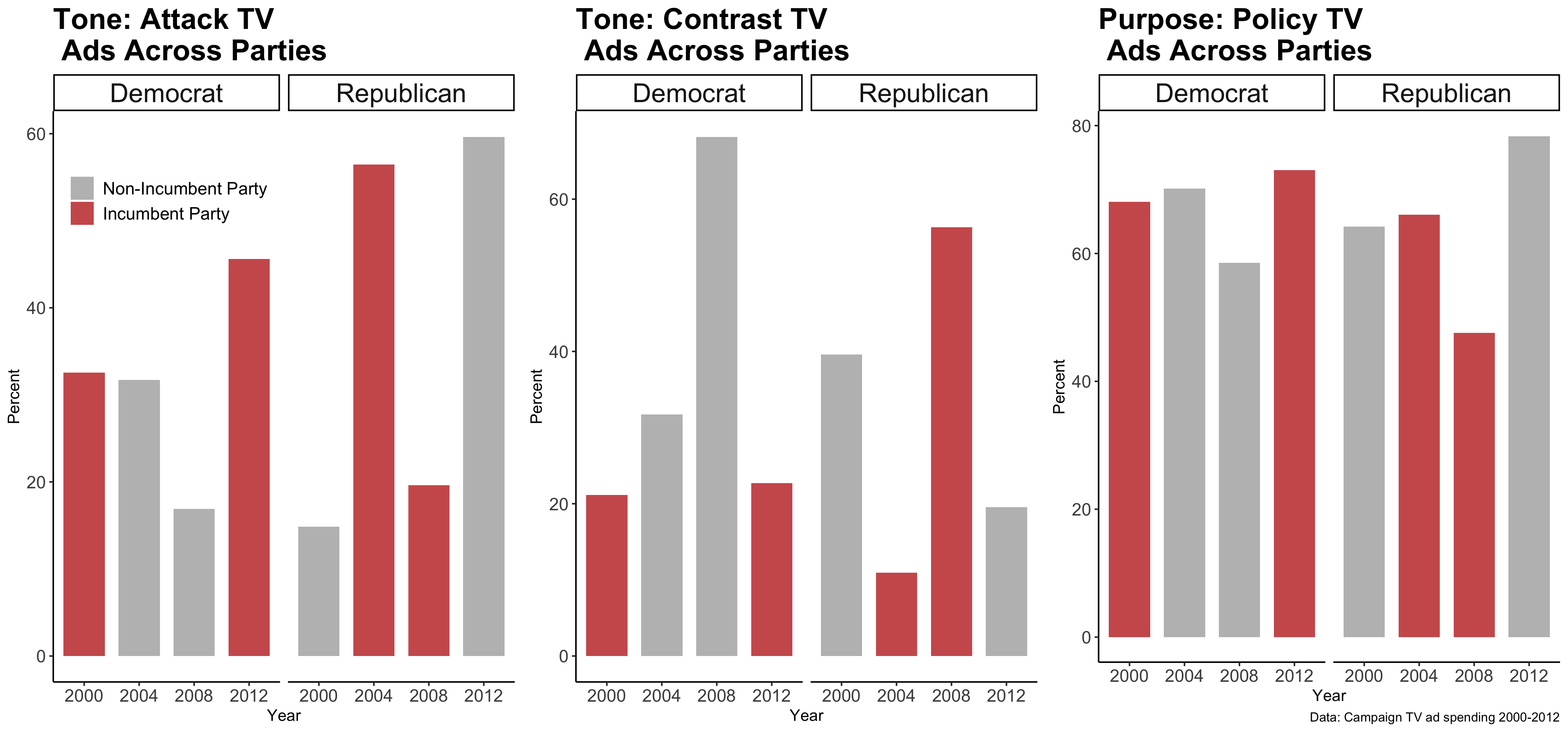

Assuming that challengers know they have an uphill battle and pour more resources into TV ads, I wondered if they also opted for a certain type of ad that would help take down the already-advantaged incumbent.

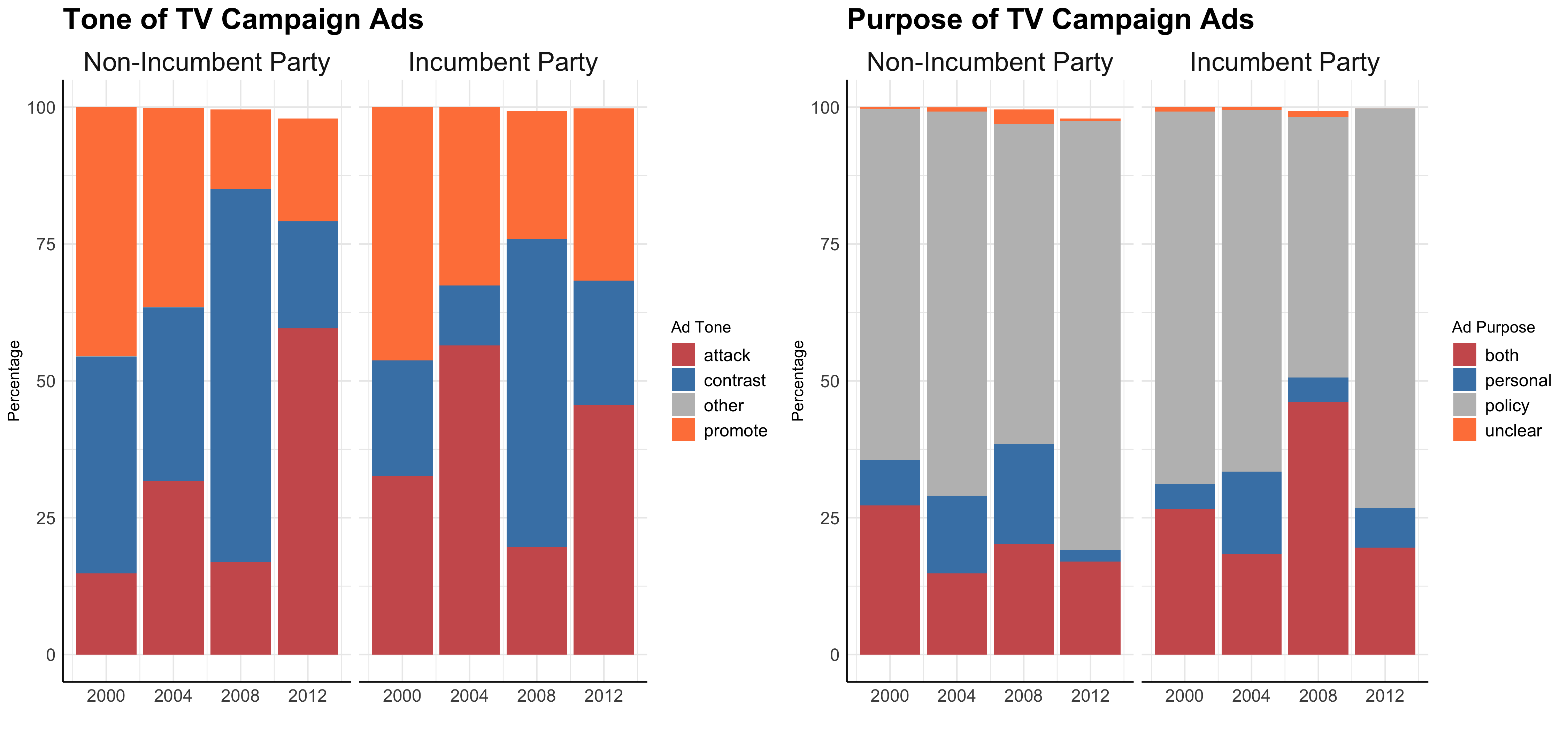

At first glance, incumbency or non-incumbency does not show a relationship pattern with any particular ad tone or ad purpose. I take a closer look at the top two tones (attack and contrast) and the top ad purpose (policy) to get a better understanding of incumbency and ad composition.

Again, I don’t see a clear trend between incumbency and tone/purpose of ads. My initial prediction was that non-incumbents would have disproportionately favored attack ads that zeroed in on policy for the following reasons:

- The incumbent has an advantage, so “attacking” can help narrow the gap

- The incumbent’s policies are well-established after a term in office so a challenger would have to especially focus on conveying their agenda

While my predictions proved incorrect in the 2000-2012 elections, perhaps there is some helpful insight for future campaigns: focusing on attacking an incumbent and conveying a challenger’s policy could help a challenger campaign shrink the incumbent advantage.

Main Points

- Non-incumbents out-spend incumbent party candidates presumably to compete with the incumbent advantage

- There is no clear pattern between incumbency and ad tone/purpose

- Campaigns spend more on ads as election day approaches (presumably to cope with the quick decay of ad persuasion)

2020 Update

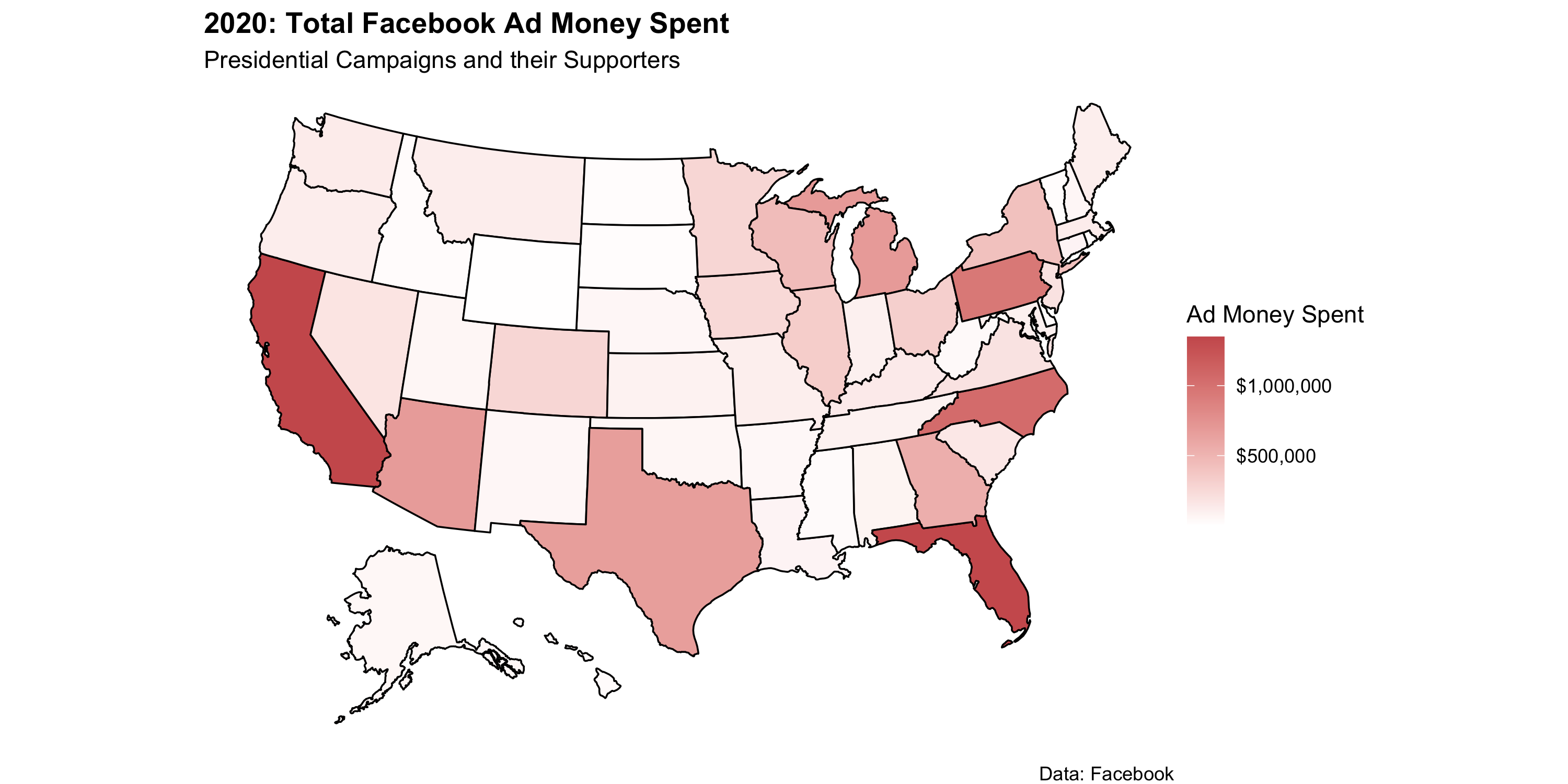

With a firm overview of TV campaigning under our belt, it’s time to take a quick look at 2020! While there’s limited data on current social media spending, Facebook has started to release its data on presidential ad purchases. These are purchases not only made by the official campaigns, but other PACs and organizations behind either candidate.

Projected swing states like Florida, Pennsylvania, North Carolina, and even Texas are getting the bulk of FB ad spending to date. Interestingly California has a heavy amount of spending though it is firmly projected to vote Biden.

Concluding on Ads

Overall, we’ve seen that ads are strategically employed in battelground states (though not restrospective swing states). Swing is negatively correlated with ad spending presumably because of a campaign’s miscalculations on what will or will not be a battleground state or their own caution.

As for incumbency, we’ve seen that non-incumbent parties spent more than incumbent parties and that both spend more and more approaching election day. That’s where the pattern ends with incumbency and ads - the tone and purpose of ads does not seem to correlate with incumbency.

Finally, as we look to 2020, states like Florida, Ohio, and North Carolina are getting plenty of Facebook ads. These seem to be some of the main battleground states going into November. Perhaps with sustained ad purchases, the Trump and Biden campaigns can persuade some Facebook users.